About to break out! Contains a lot of unmet needs, the track that Hillhouse and Sequoia love super!

June 17, 2021

After the early collection of coronary stents and the upcoming blowout of orthopedic consumables, the market’s "favor and favor for devices" seems to have receded. Following the Hong Kong Stock Exchange's disclosure on June 14th, the domestic nerve & peripheral vascular interventional device manufacturer Guichuang Tongqiao passed the hearing and brought the market's attention to a field with "huge unmet demand"-cerebrovascular disease. For a long time, vascular diseases are one of the main causes that endanger people's lives. Among them, stroke caused by intracranial vascular hemorrhage or ischemia is the leading cause of death in Chinese people. Stroke, also known as "stroke", has the characteristics of high morbidity, recurrence, disability, and mortality. There are more than 3.4 million new cases of stroke each year in my country.

Why is there a huge unmet demand and numerous investment opportunities in this field? First, based on the ever-increasing morbidity rate, the increase in the number of patients has given birth to a huge therapeutic market scale. Second, the corresponding therapeutic equipment is monopolized by imported products, and there is ample room for domestic substitution. Take devices as an example. Although domestic devices account for more than 70% in the field of intracardiac intervention, imported products account for 90% of the market in the field of peripheral and neurovascular interventions. International medical device giants represented by German Braun, Boston Scientific, Medtronic and Johnson & Johnson, with their strong financial strength and technological precipitation, firmly occupy China's peripheral vascular, intracranial stent and some high-end cardiovascular stent product markets.

一. Focus on the biggest piece of cake in the blue ocean: ischemic stroke

Cerebrovascular diseases are divided into two categories: ischemic and hemorrhagic. In terms of indication types, common indications can be divided into ischemic stroke, arterial stenosis, and aneurysm. The former two belong to ischemic diseases, and the latter belong to hemorrhagic diseases. According to the "China Stroke Prevention and Treatment Report (2018)", in 2017, patients with ischemic cerebrovascular disease accounted for 73.79% of new neurological patients, and patients with hemorrhagic cerebrovascular disease accounted for 26.21% of new neurological patients. Judging from the statistics of France in 2019, where cerebrovascular interventions are more developed, stroke is the disease with the largest market share, followed by aneurysms and cerebral artery stenosis. It is expected that this trend may also appear in my country in the future.

Take the intersection of the two, then the answer to the industry's "biggest cake" is: ischemic stroke.

Similarly, this year's comparative data on the incidence of hemorrhagic stroke and ischemic stroke, and the number of people discharged from the hospital also confirmed the above judgment.

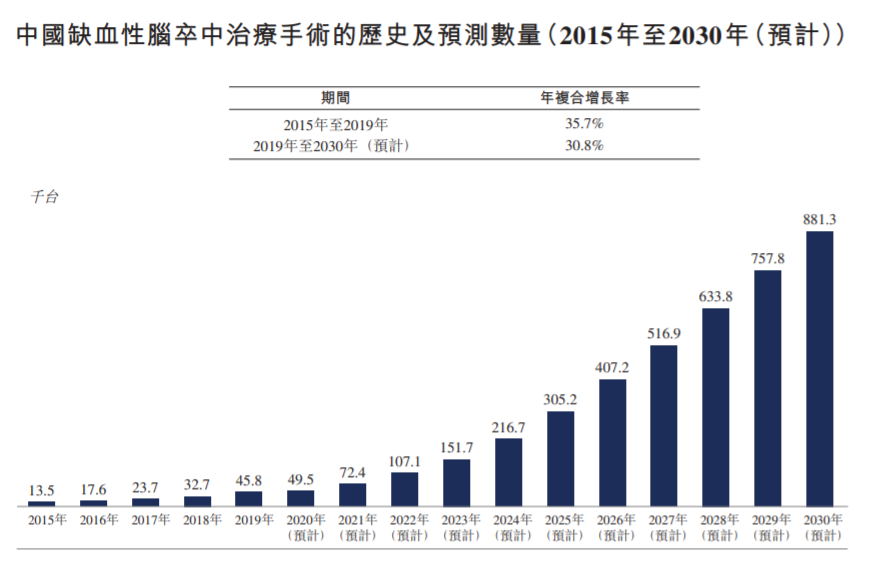

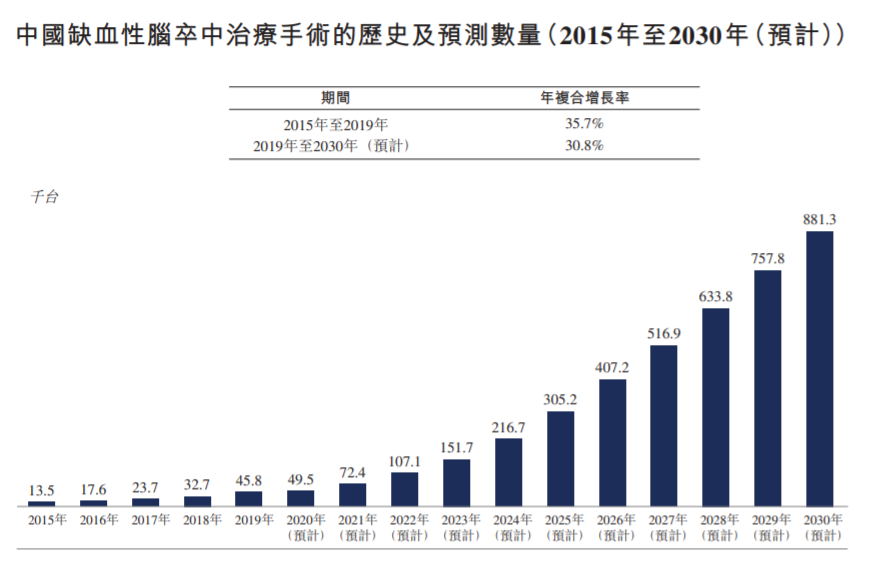

In terms of operation volume, the number of domestic ischemic stroke treatment operations increased from 13,500 units in 2015 to 45,800 units in 2019, with a compound annual growth rate of 35.71%. It is expected to increase to 881,300 units in 2030, with a compound annual growth rate of 30.8% from 2019 to 2030, maintaining a very rapid growth.

The growth rate and space of the medical device market used in the treatment process are also attractive. The market size of the domestic ischemic stroke neurointerventional device market has increased from 380 million yuan in 2015 to 1.9 billion yuan in 2019, with a compound annual growth rate of 49.7%. From the perspective of the total amount of drugs, the size of my country's stroke drug market has exceeded 100 billion.

二. The neural intervention layout of the two giants Hillhouse and Sequoia

Even though it seems that the market for stroke drugs seems to be broader, the development of new stroke drugs has been a difficult problem for many years. Based on the complexity of cerebrovascular diseases, the difficulty of clinical recruitment, and the ambiguity of clinical evaluation, factors such as stroke adaptation in recent years Few new drugs have been approved. Due to the scarcity of target drugs in the drug market, first-tier institutions have turned their attention to the field of neurointerventional devices, which is still in the lead-in period and has broad development prospects. Speaking of the layout of VC/PE in the field of neurological equipment, the big-name institutions that cannot be missed must be Sequoia and Hillhouse, which have almost paved the track. Let’s talk about Hillhouse. At the level of listed companies, listed neurointerventional device companies are currently relatively scarce. Hillhouse has invested in MicroPort Medical and Peijia Medical. MicroPort Medical’s MicroPort has a wealth of stroke interventions among domestic companies. Product line, while Jiaqi, a subsidiary of Peijia Medical, owns the coil products already on the market and the Shenyi embolization stent that is expected to be on the market in recent years. In the primary market, Hillhouse Capital will make 15 shots in the field of medical devices in 2020, of which 4 shots are related to the field of neurointervention, including Bomai, which has a portfolio of cardiovascular interventions & peripheral vascular interventions & neuro interventions. Medical, Hemu Biology, which has the first domestic approval for aspiration catheters, Woby Medical, the only neuroembolization intervention product that has been certified in many overseas locations, and Creichi, an interventional platform with neurointerventional microcatheters.

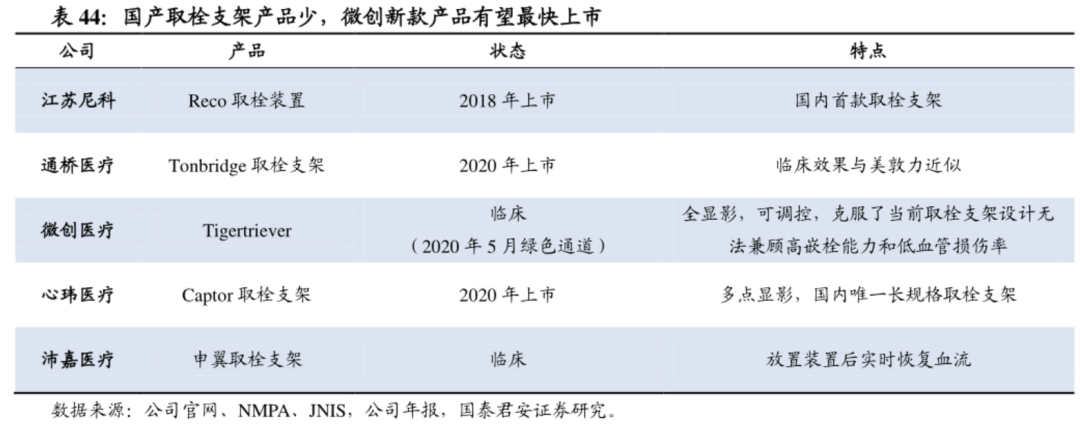

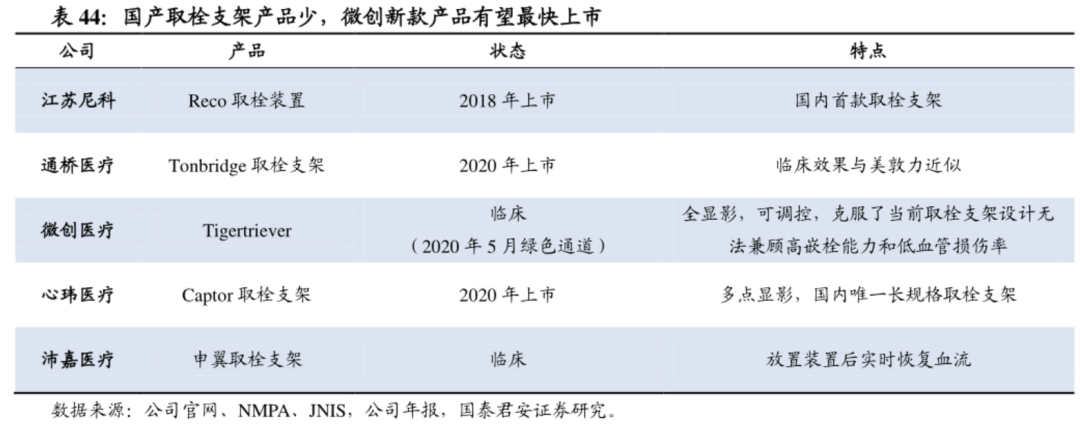

Time jumps to February 2021. Hillhouse Ventures continues to lead the investment in Micro-Medical, an innovative manufacturer focused on neurointerventional devices. Its main research and development direction is the next-generation solution of embolization coils-the dense mesh occluder. In contrast to Hillhouse's "track theory" strategy, Sequoia's strategy is different. Sequoia has established two companies in the field of neurointervention, namely HealthScience Medical and Eco Medical. Jianshi Medical's neurointerventional products originated from the acquisition of Jiangsu Nico. Nico's Reco cerebral thrombus removal device is the first domestically approved embolectomy stent in China, which has a certain first-mover advantage of domestic replacement. Eco Medical has continued to follow up Sequoia's B and B+ rounds. The company has deployed a full product line around this neurological intervention, including products such as hemorrhagic stroke treatment, ischemic stroke treatment, and access aids. The "voting with feet" of the two major PE giants also revealed to a certain extent that this is a high-quality and promising track.

三. Core opportunities that can be paid attention to: ischemic devices, innovative drugs for stroke, and rehabilitation devices

Based on the above description of the market prospects and the stroke treatment process, we can draw three key directions worthy of attention. One is the high frequency and important thrombus removal products of interventional devices, the second is innovative drugs related to stroke indications, and the third It is the market for rehabilitation treatment equipment and services for the prognosis of stroke patients.

1. The core equipment of thrombectomy therapy: thrombectomy stent and suction catheter

Quoting from an insider: "Because of the higher incidence of ischemic stroke, the market for thrombectomy products should be larger than that of aneurysm interventional products, and the market share is even dozens of times larger."

Thrombus removal and aspiration are important aspects of interventional surgery for acute stroke. The performance of the device is related to the life of the patient. Therefore, we pay attention to the core opportunity of interventional devices in the replacement of embolization stents and suction catheters. There have been controversies in the industry regarding the better performance of embolectomy stents and suction catheters in embolectomy, and no distinction is made here. Medtronic currently occupies two-thirds of the domestic market, and there are also foreign giants such as Johnson & Johnson, Medtronic, Stryker and other foreign giants. Domestic products are currently Jiangsu Nico's Reco approved as early as 2018; Guichuang Tongqiao Jiaolong The thrombus removal stent was approved in September 2020 and sold 10.6 million yuan in less than a quarter; Xinwei Medical’s multi-segment visualization thrombus removal stent system Captor was approved in 2020 and the company is currently preparing for commercialization; In the next two years, Peijia and Wicresoft's competing products will be launched on the domestic market accordingly, first to fight for performance, and second, to fight for commercialization capabilities based on performance.

According to industry insiders, the development and production of suction catheters seems to be more difficult than stent removal. At present, domestic foreign manufacturers with approved products include Penumbira, Zeon, Medtronic, etc., and domestic manufacturers are currently only approved by Hemu. In addition, Xinwei Medical and Puweisen have entered the clinical stage.

2. Pan-good stroke drugs

Inventory of the research and development of new drugs in the field of stroke in recent years, as of 2020H1, a total of 12 domestic drugs under development for the treatment of stroke are in the clinical stage or waiting for new drug application approval, and there are few innovative drugs that have been marketed. Even if the new stroke drug is good, but the only new stroke drug approved in the world in the past five years, "First must be new" (Sincere Pharmaceuticals), is worthy of attention. There are two main options for the treatment of acute ischemic stroke. One is curative: intravenous thrombolytic therapy or intravascular therapy is carried out within a time window (less than 6 hours), that is, thrombus removal. At present, most patients cannot receive thrombolytic therapy within the time window, so the second option is mainly to "buy time" for these patients. The use of neuroprotective drugs to reduce the brain damage of patients is of great significance for reducing the disability of patients. First must be new is the me-better of old drugs "must exist", which can extend the current treatment time window from 24 hours to 48 hours, which is of great significance to the treatment of stroke. In March of this year, Xian Bixin has been included in the medical insurance catalog, and the speed of hospital admissions and sales have exceeded market expectations. In addition, it is worth noting that Xiansheng has global rights and interests in this drug, and there may be license-out expectations overseas.

3. Rehabilitation treatment gradually being tapped by the market

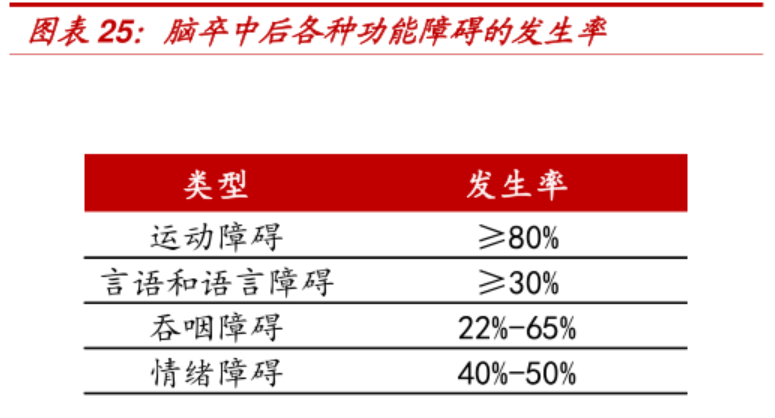

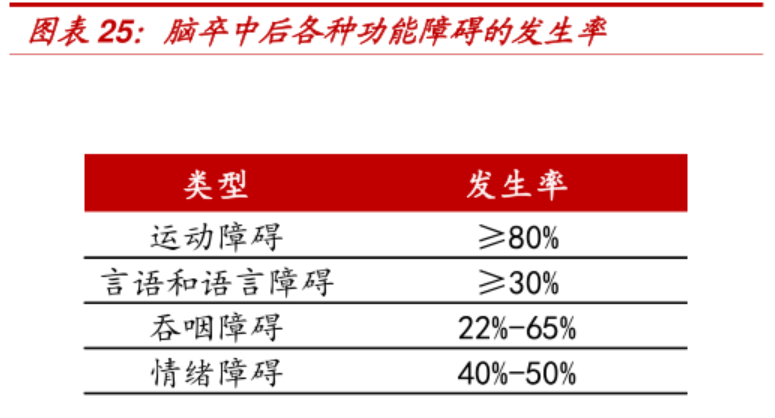

The "Chinese Stroke Rehabilitation Treatment Guidelines 2011" pointed out that 70%-80% of the 2 million new stroke patients each year cannot live independently because of disability. Evidence-based medicine and modern rehabilitation theory and practice have proved that stroke rehabilitation is the most effective way to reduce the disability rate, and effective rehabilitation training can reduce the functional disability of patients.

Based on the double increase in the incidence of stroke and the penetration rate of post-operative rehabilitation, both rehabilitation medical services (rehabilitation hospitals) and rehabilitation medical-related equipment have broad prospects, but the investment should consider the barriers of rehabilitation equipment and rehabilitation chain hospitals. The reproducibility and profitability of other existing problems. Listed companies related to equipment include Weiss Medical and Xiangyu Medical, and service companies include Samsung Medical, which will not be listed here.