Innovative drugs, vaccines, CDMO, and the IPOs of major new players in the pharmaceutical industry this Wednesday, who is more powerful?

May 31, 2021

"Innovation", as the main driving force of the biomedical industry in recent years, has forced the industry to actively seek technological and model advancement. Especially after the "new crown epidemic" that broke out last year, the psychological status of the pharmaceutical industry has soared. Among them, vaccines, innovative drugs and CDMO industries have received the most attention, and they have become the "Future Star" of the pharmaceutical industry. This week (5.24-5.28) the pharmaceutical industry also ushered in the purchase of three pharmaceutical companies. Although Sino Biotech and Haoyuan Pharmaceutical belong to the CDMO industry, there is a clear difference in their core businesses. Olin Biotech is A biopharmaceutical company with human vaccines as its main business. As for the three companies, who is better? Who can represent the rookies in medicine in the new era needs to be analyzed one by one.

CDMO Representative--Sino Bio

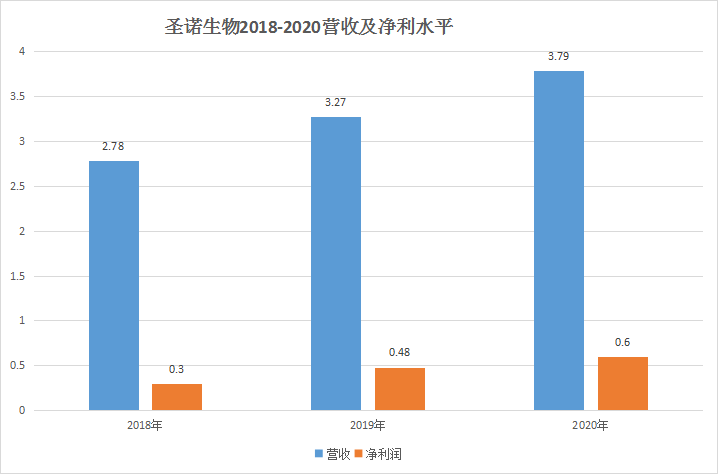

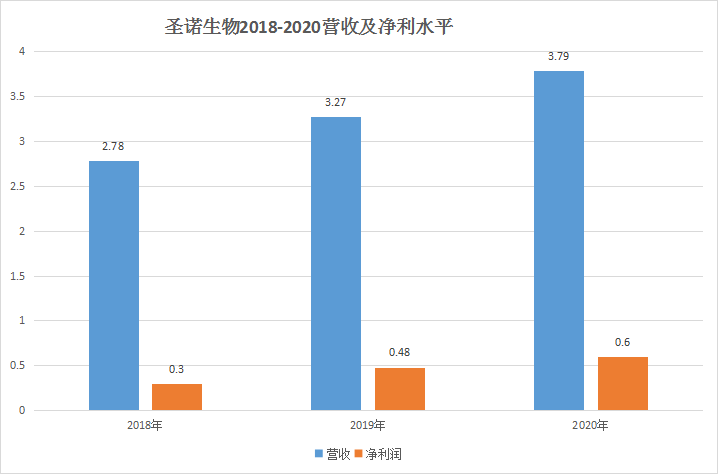

Sino Bio is an innovative pharmaceutical company focusing on the field of peptides. Its main business is "independent research and development, production and sales of some peptide raw materials and preparations", "polypeptide innovative drug CDMO services", "Levosimendan preparations and raw materials Production and export sales" three parts. According to the prospectus, Senobio currently has mastered the large-scale production technology of 15 varieties of APIs, of which 7 varieties have obtained domestic production approvals, 8 varieties have obtained the US DMF registration (activated state), and 8 peptides developed by extension The preparation varieties have obtained 12 production approvals in China, and the products cover multiple fields such as immune system diseases, tumors, cardiovascular, chronic hepatitis B, diabetes and obstetric diseases. As a late-starting field in China, the peptide field that Sino Biotech focuses on is characterized by a late start and rapid development. Sales rose from 5.6 billion yuan in 2009 to 29.56 billion yuan in 2017, with an average annual compound growth rate. The rate is as high as 23.12%, which is much higher than the overall growth rate of the global peptide drug market. At present, there are more than 40 kinds of peptide drugs on the market in China, most of which are dominated by imported drugs. There is huge space for generic drugs behind it. Therefore, a large number of professional peptide drug manufacturers have been born in China, and Sino Bio is one of them. And to judge whether an enterprise is excellent, the most basic element comes from the discussion of its "management" and "core competitiveness". In terms of company operations, the most condemned by Shengnuo Biotechnology is its high proportion of marketing expenses. According to the prospectus, from 2018 to 2020, Shengnuo Bio's marketing expenses will be 109 million yuan, 160 million yuan, 176 million yuan, accounting for 95.51%, 96.2%, 96.62% of sales expenses, accounting for more than 84% of operating income, leading the public to generally doubt its hidden operating risks. Although it was explained by Shengnuo Biologics during the period: "The preparation products currently sold by Shengnuo Biologics have a short time to market, and they need to rely on professional market promoters to market the products. The promotion workload is relatively large, so the promotion cost is relatively high. At a reasonable level."

However, Sinobio's excessive reliance on marketers for marketing has undoubtedly exposed major shortcomings in its operations. Just imagine that no company is completely dependent on marketers for sales. This undoubtedly means that The out-of-control of the product landing is equivalent to being choked by someone for a pharmaceutical company. As for the latter's core competitiveness, it needs to be judged based on its comparison with competitors' products.

1. According to the prospectus of Sino Biotech, the market competition of its main products is not optimistic. The overall performance of most of the varieties is insufficiently competitive, and the market share is at a relatively low level except for a few varieties, and even some products are competitive. There are as many as dozens of manufacturers.

2. According to Shengnuo Biological, based on pharmaceutical research and customized production services, the comparison companies are Kailaiying, Boten and Kanglong Chemical. However, whether it is the income level in the CDMO field or the ability to customize production services, Shengnuo Biological can not be compared with the above companies. Taking Boton as an example, in 2020, the income from the CDMO field is 1.449 billion yuan, and the income from the CRO field is 564 million yuan. And the former layout has gradually penetrated into the overall situation of API + preparations + macromolecular CDMO, and the biological and preparation CDMO business will achieve an order "break" during 2020.

Perhaps the only advantage of Sinobio in the CDMO field is to focus more on the business structure of the peptide field. In addition, compared to the comparison company, it is regarded as Boten and Kanglong Chemical, replaced by Jiuzhou Pharmaceutical and Prologue. The pharmaceutical industry may be more appropriate. On the whole, at least now, regardless of its operating capabilities or the core competitiveness of the industry, Sinobio is not excellent to some extent, and in terms of development potential, it is not as good as the companies listed before him. . In this way, what is left of the true significance of the listing of Sino Bioscience and Technology Innovation Board?

CDMO representative--Haoyuan Pharmaceutical

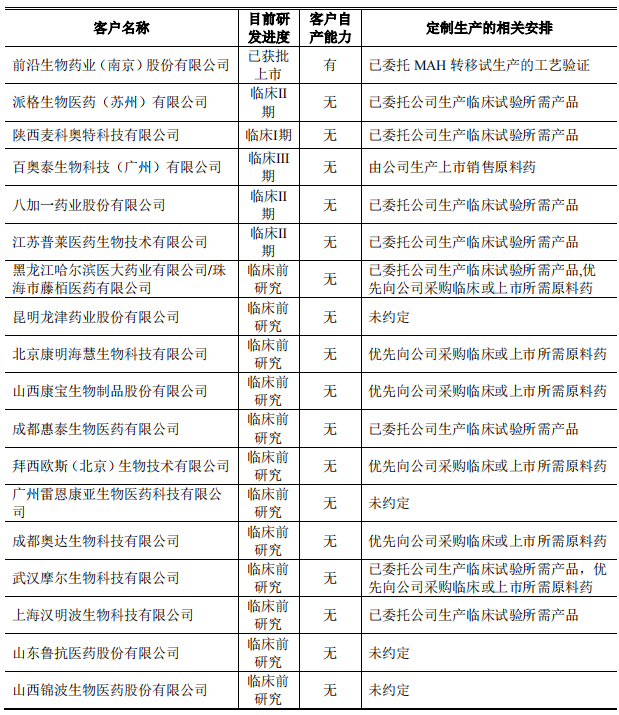

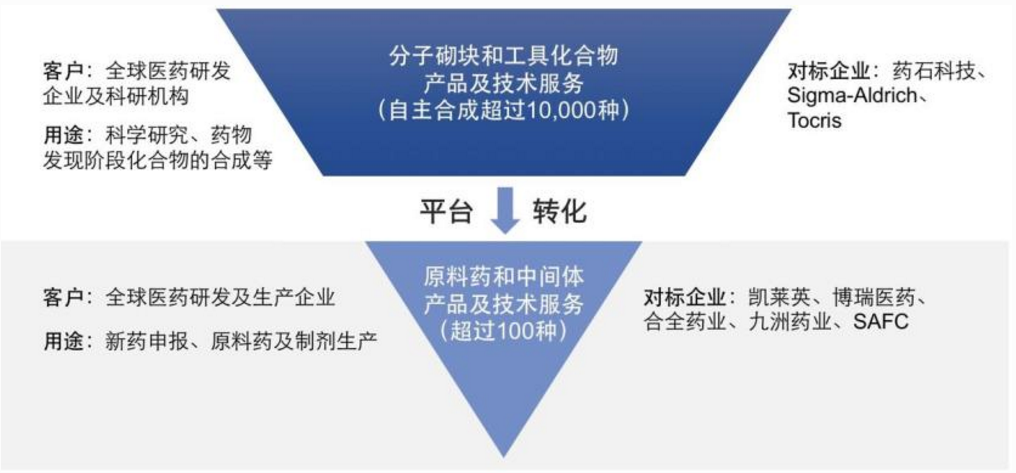

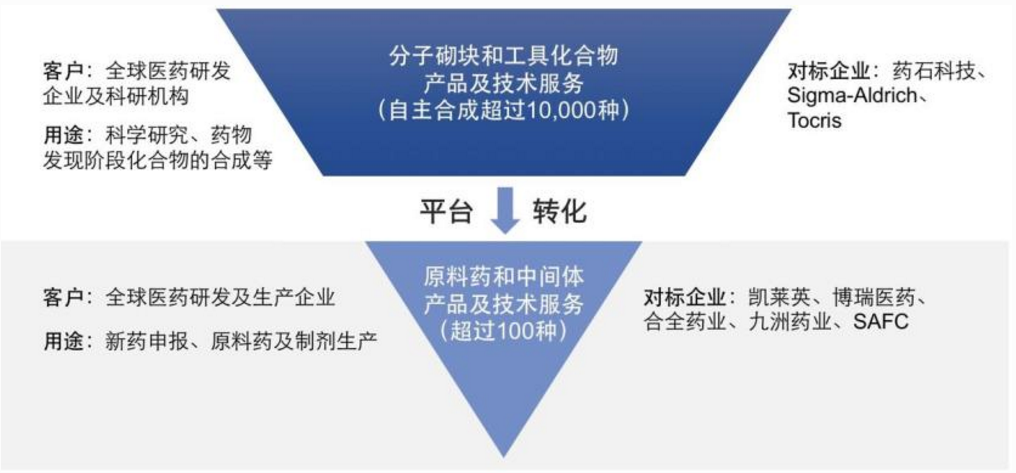

On May 19, Haoyuan Pharmaceutical disclosed its prospectus, and publicly issued 18.6 million RMB ordinary shares (A shares). The funds raised this time will be used for the implementation of the company's API and intermediate products and technical service projects. The official subscription time is initially set to be this Friday (May 28). Haoyuan Pharmaceutical's main business is molecular building blocks and tool compounds-product sales and API and intermediate development business-product sales, accounting for 49.92% and 42.91% of 2020 revenue respectively.

At the same time, it is worth noting that the end customers of Haoyuan Pharmaceutical's molecular building blocks and tool compound services cover most of the world's biomedical research institutions and pharmaceutical companies, including Pfizer, Lilly, MSD, Abbvie (Abbvie), Gilead (Gilead) and other multinational pharmaceutical giants and domestic research institutions such as Shanghai Institute of Pharmaceuticals, Shanghai Institute of Organic Chemistry, and universities such as Peking University and Tsinghua University.

As for competitors, Haoyuan Pharmaceutical's molecular building blocks and tool compounds are mainly Yaoshi Technology, Aladdin, and Titan Technology; raw materials and pharmaceutical intermediates are companies such as Borui Biology, Kailaiying, and Jiuzhou Pharmaceutical. After the deliberation of Haoyuan Pharmaceutical was suspended on November 9th, the meeting was successfully passed. More people are concerned about whether the issues raised before have been resolved. On the one hand, Haoyuan Pharmaceutical’s previous molecular building block and tool compound business involved third-party products during the patent period, which were suspected of patent infringement. After an inquiry on the Shanghai Stock Exchange, the reply stated that it complied with the “safe harbor clause” of the United States and was not considered Infringement; At the same time, it is indeed mentioned in the "Patent Law of the People's Republic of China" that "the use of related patents exclusively for scientific research and experimentation" is not regarded as an infringement of patent rights. But on the other hand, Haoyuan Pharmaceutical’s prospectus also clearly stated that the company’s tool compounds are sold to pharmaceutical manufacturers, scientific research units, and universities for scientific research and drug certification applications. This is not the same as using such products as There is an obvious conflict in the results of the profit from the sale of substantive commodities. Whether it is completely applicable to the "Safe Harbor Regulations" or not, there is undoubtedly a certain degree of risk. However, before Haoyuan Pharmaceutical, there was no domestic listed company with “tool compound” as its main business, and there was no absolutely qualified corporate experience to learn from. At the same time, if Haoyuan Pharmaceutical can create the first "tool compound" on the market, it may also open up a new revenue idea for the pharmaceutical industry in a sense!

Vaccine Representative--Olin Bio

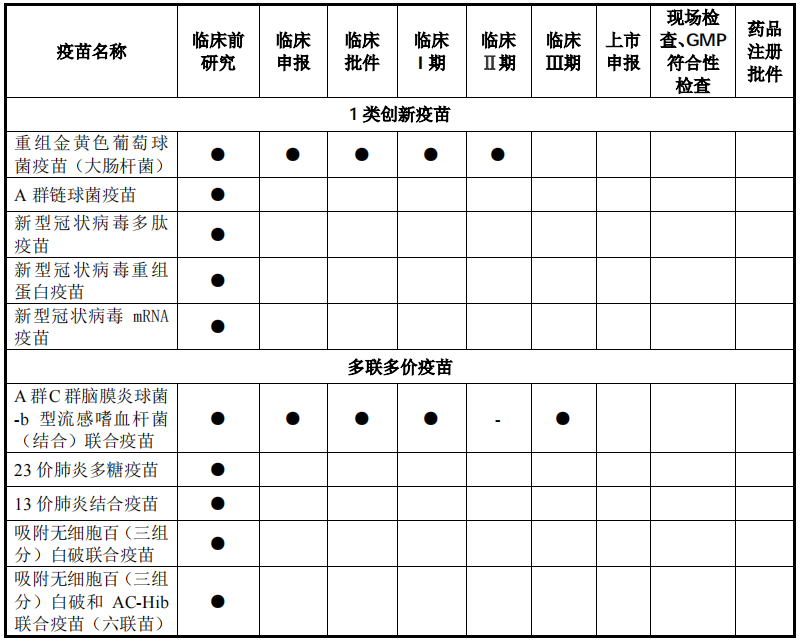

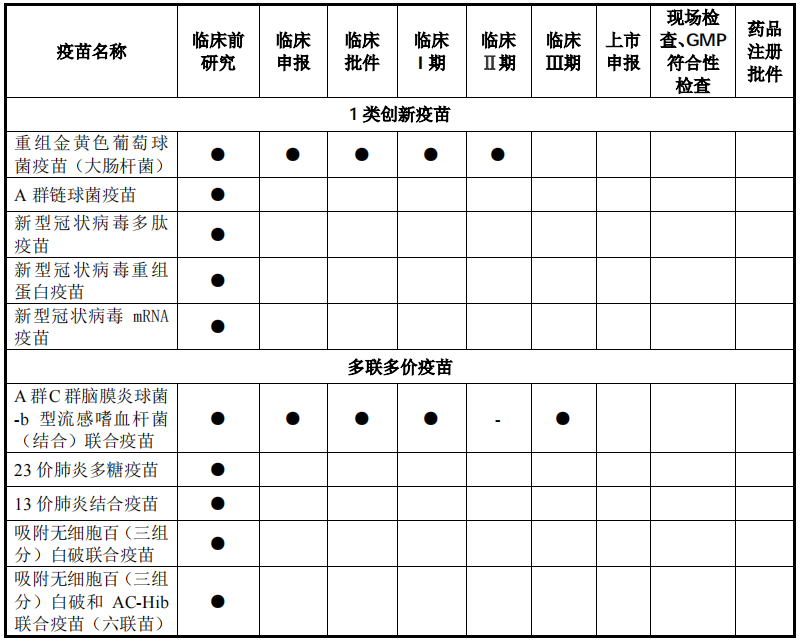

For the standards Kanghua Biology, Kangsino, Kangtai Biology, Watson Biology, Zhifei Biology, once listed, it means to fight against behemoths with a total market value of over 500 billion. Olin Biology officially announced that it will also officially start purchasing on May 27 , The listing is coming soon. According to the prospectus of Olin Biotechnology, it is a biopharmaceutical company focusing on the research and development, production and sales of human vaccines. At present, three vaccine products, the adsorbed tetanus vaccine, Hib conjugate vaccine, and AC conjugate vaccine, are on the market. However, it is more noteworthy and investors are more concerned about the development of 10 vaccines in the development of Olin Biotech's growth engine, or maybe it is the 5 innovative Class 1 vaccines and 5 multivalent multivalent vaccines it is researching.

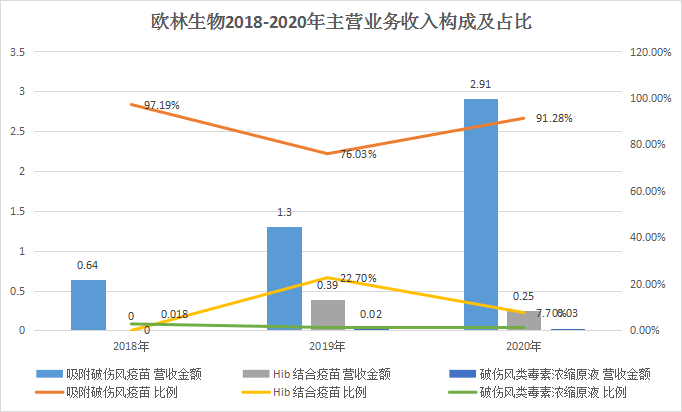

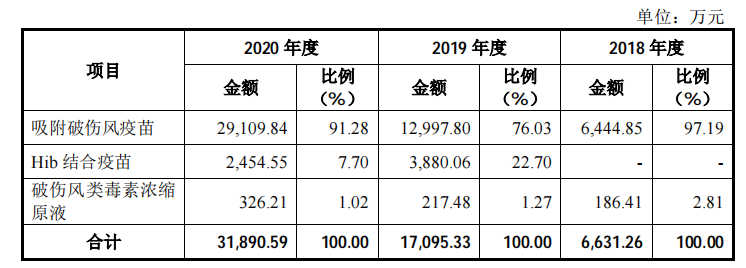

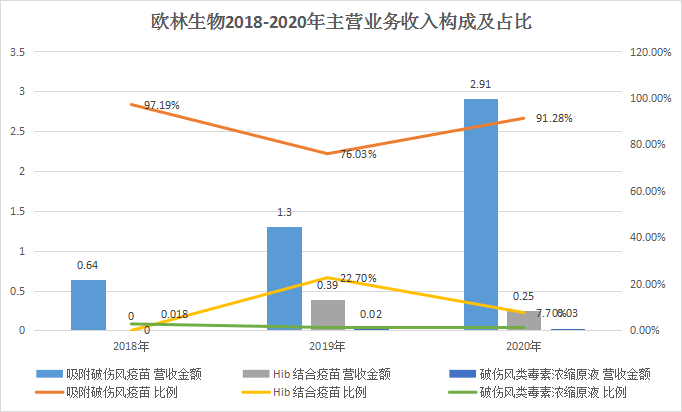

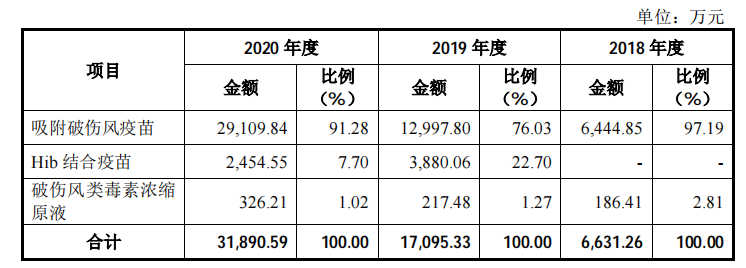

The new shares of Olin Biologics intends to raise 763 million yuan, which will also be used for recombinant Staphylococcus aureus vaccine, AC-Hib combined vaccine and pneumonia vaccine industrialization projects, and vaccine clinical research projects. According to the data, Olin Biotech’s “adsorbed tetanus vaccine” is the first product to open up the tetanus vaccine disease control center market in China. Its sales revenue has increased from 13 million yuan in 2017 to 290 million yuan in 2020, and its market share is The rate reached 82.64%. In 2020, the company’s absorption of tetanus vaccine sales accounted for 91.28% of its revenue, and it is expected that relying on the market’s first-mover advantage, there will still be good growth prospects in the future.

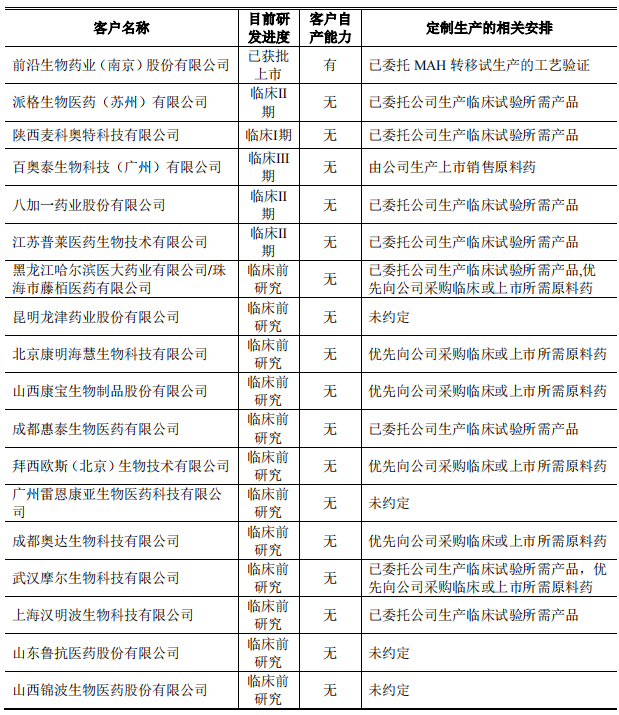

Among the vaccine research projects, the “recombinant Staphylococcus aureus vaccine” jointly developed with the National Institute of Immunobiological Products Technology Research Center of Army Military Medical University is the "recombinant Staphylococcus aureus vaccine", which is the most component of the Staphylococcus aureus Type 1 vaccine, worldwide, At present, no recombinant Staphylococcus aureus vaccine has been successfully tested in clinical trials and is on the market. Olin Biosciences plans to complete Phase II clinical trials within 2021. At the same time, Olin Bio’s AC-Hib combined vaccine product is currently in phase III clinical trials, and it is also one of only two companies. It is expected to go on sale in 2023. The remaining products under research overlap with early listed companies such as Luo Yi, Kangtai, Watson, and Zhifei. However, in terms of surface potential, Olin Bio is still the largest of the three pharmaceutical companies that have subscribed this week, and it is very likely to be widely recognized by the capital market.

to sum up

According to relevant reports, the development speed of Chinese medicine is expected to increase at an annualized rate of 4% in the next ten years. Under the overall view of the slowdown in growth, the field of innovative drugs has undoubtedly become a carefully selected field, and the CXO field is compared In the field of innovative drugs, the concept of risk reduction and equal returns has been realized. Combined with the current CRO industry being on the eve of the outbreak, it will undoubtedly be an advantageous industry; as for the vaccine industry, it is currently benefiting from the new crown epidemic, and the degree of attention has been greatly increased, but its huge production Cost and management requirements have also become the disadvantages of most new entrants. In the future, it may be possible to expect the combined development of the CDMO industry and the vaccine industry. But in any case, at least the current vaccine potential is much higher than CXO, as for the next ten years, perhaps the throne will belong to the latter.

Editor in charge: Penicillin