Review of the first half of 2021: Hotview Biotech's growth rate is the first, and medical equipment welcomes IPO financing

July 13, 2021

In the first half of 2021, due to the impact of the new crown epidemic in some regions, pharmaceutical companies such as medical devices and biological vaccines have been favored by the capital market. By combing through the top ten stocks in the pharmaceutical industry in the first half of 2021, it is found that medical device companies account for half of the seats, Chinese medicine companies account for two, and chemical preparations, medical services and chemical raw materials each account for one. Among them, Hotview Bio (+404.13%), Harbin Sanlian (+261.94%), and Medicilon (+232%) had the highest gains in the first half of the year. At the same time, the sci-tech innovation board market ushered in a blowout of pharmaceutical companies' IPOs in the first half of the year, and a total of 22 pharmaceutical "upstarts" were listed on the market. Among them, medical device companies are ushering in a climax of IPO financing. What kind of market laws are behind the skyrocketing of these bull stocks? What laws will continue in the future? It is what we need to focus on.

1. The medical device sector ranked among the top gainers, and Hotview Biotech won the “laurels” on the rising list

In the TOP20 list of the pharmaceutical industry in the first half of 2021, there are 8 medical devices, 4 medical services, 3 traditional Chinese medicines, 2 biological products and chemical raw materials, and only 1 chemical preparation. At the same time, pharmaceutical companies listed on the Science and Technology Innovation Board accounted for as many as 11 seats.

These 20 big bull stocks in the pharmaceutical industry are closely related to the new crown epidemic, benefit from the popularity of medical beauty, and some benefit from bankruptcy and reorganization.

1. Laureate of the increase list-Hotview Bio

Hotview Bio is a medical device company engaged in the business of in vitro diagnostic reagents and instruments. It has core technology products such as hepatitis B virus pregenomic RNA (HBVpgRNA) assay kits and "triple inspection for early diagnosis of liver cancer". In 2019, the domestic market sales accounted for as high as 98.14%. Since the outbreak of the new crown epidemic in 2020, Hotview Bio has developed a new coronavirus (2019-nCoV) IgM antibody detection kit (colloidal gold method) and a new coronavirus (2019-nCoV) antibody detection kit (up to luminous). Immunochromatography) and more than ten new coronavirus detection products with different methodologies, and have successively obtained European Union CE and certifications from many countries and regions. Although the company missed the opportunity period in the domestic and international markets in the first half of the year due to the late certification time, the company's foreign trade orders surged in the fourth quarter as the foreign epidemic continued to increase, and the company achieved revenue of 368 million yuan in a single quarter (+ 407%), deducting 110 million yuan (+598%) of non-net profit.

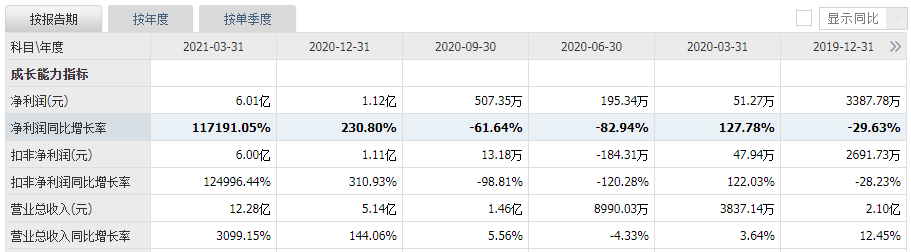

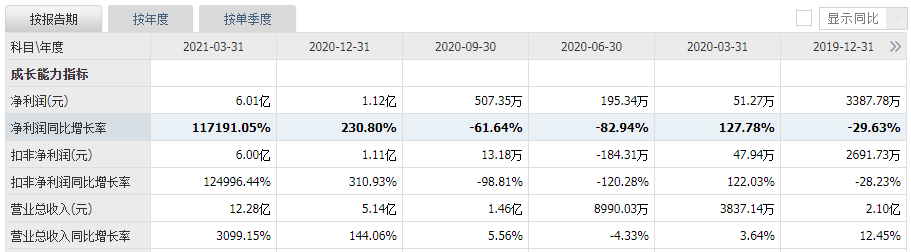

The performance growth of Hotview Biology

Source: Straight Flush

In 2020, Hotview Bio will achieve total revenue of 514 million yuan, a year-on-year increase of 144%; deduct non-net profit of 111 million yuan, a year-on-year increase of 311%. Among them, diagnostic reagents achieved revenue of 488 million yuan, accounting for 95.08% of total revenue; overseas sales accounted for 61.44%. In the first quarter of 2021, the performance of Hotview Biology continued to explode: total revenue was 1.228 billion yuan, a year-on-year increase of 31 times; non-net profit deducted 600 million yuan, a year-on-year increase of 1,250 times. Such adverse performance has caused the company's stock price to skyrocket since April.

Share price chart of Hotview Bio in 2021

Source: Oriental Fortune Network

In addition, there are many pharmaceutical companies that have benefited from the new crown epidemic and have seen substantial growth in performance. For example, Gongdong Medical, whose main business is disposable medical consumables, includes vacuum blood collection systems, laboratory testing consumables, body fluid collection consumables, medical care consumables, and pharmaceutical packaging materials. In 2020, total revenue will be 830 million yuan, a year-on-year increase of 50%; net profit will be 226 million yuan, a year-on-year increase of 98.86%. In the first quarter of this year, it continued to grow, achieving total revenue of 226 million yuan (+155.93%) and net profit of 79.36 million yuan (+232.18%). After the outbreak of the new crown epidemic, Ailong Technology, which launched unmanned isolation pharmacies, intelligent sample storage, and medical waste disposal systems, was also a company listed on the Science and Technology Innovation Board on March 29 this year. Cansino Bio, which owns the adenovirus vector new crown vaccine, also rose 107.9% in the first half of the year, with a total market value of more than 120 billion yuan.

2. The hot spot in the first half of the year-medical beauty

In the first half of this year, pharmaceutical companies related to the medical beauty business were highly sought after by investors. For example, Harbin Sanlian, which ranks second in the A-share pharmaceutical industry's rise list, rose by 261.94% in the first half of the year. Harbin Sanlian is mainly engaged in the research and development, production and sales of chemical preparations, raw materials, medical devices and cosmetics. Among them, the cosmetics business mainly comes from the shareholding company Fuerjia, and its main products include recombinant collagen water-light repairing patch, Fuerjia Centella soothing repairing patch and so on. In 2020, the cosmetics business will achieve revenue of 187 million yuan, accounting for 14% of total revenue. However, the main income of Harbin Sanlian is still from the pharmaceutical business. Last year, it achieved income of 1.146 billion yuan, accounting for 85.57%. Among them, lyophilized powder injections, large infusions, solid preparations and medical devices achieved revenues of 411 million, 205 million, 202 million and 173 million respectively, accounting for 30.7%, 15.34%, 15.09%, and 12.93% respectively. The real medical beauty companies, from the "Three Musketeers of China's Hyaluronic Acid", Haohaishengke, Aimeike, and Huaxi Biology, increased by 132%, 117.9%, and 89.76% respectively in the first half of the year. Haohaishengke is the leader in hyaluronic acid raw materials and the world's largest hyaluronic acid production and sales company, accounting for 39% of the global hyaluronic acid market. In recent years, it has begun to expand to downstream dermatology and orthopedic products. The current main business includes ophthalmology, medical beauty and wound care, anti-adhesion and hemostatic products. Among them, medical beauty and wound care products will achieve revenue of 242 million yuan in 2020, accounting for 18.16%

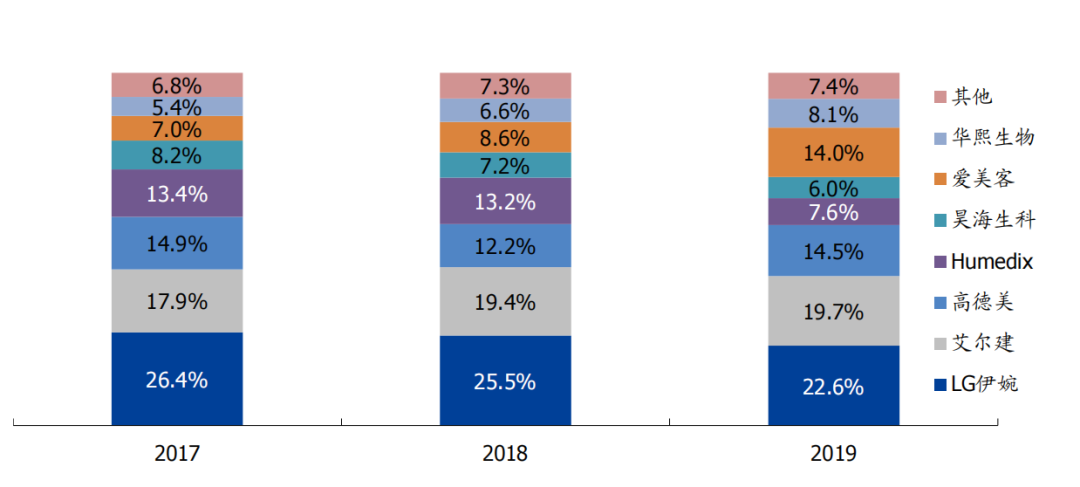

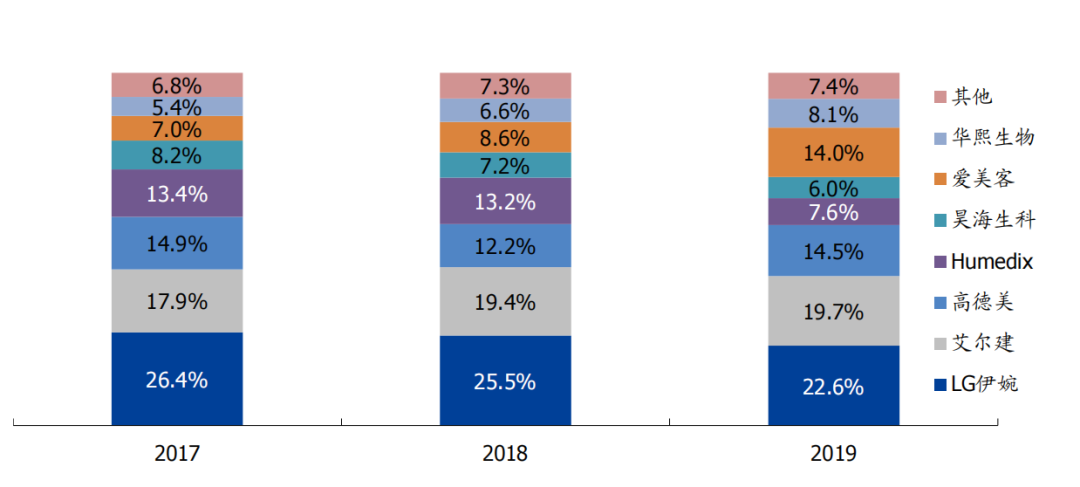

Competitive pattern of domestic medical beauty hyaluronic acid market (according to sales ratio, %)

Source: Frost&Sullivan, Guosheng Securities Research Institute

In 2020, Amico's solution injection products and gel injection products will achieve revenues of 447 million yuan and 252 million yuan respectively, accounting for 98.62% of total revenue. Secondly, cosmetics and facial implants achieved revenues of 7,885,400 yuan and 1,842,200 yuan respectively, accounting for 1.37% of the total. According to Frost & Sullivan’s research report statistics, the market share of Amec's uric acid in 2017-2019 continued to rank first in China; as of 2019, Amec's hyaluronic acid sales ranked first in the country, with a market share of 26.5%. The sales amount ranks fourth in the country, with a market share of 14.0%. It is worth mentioning that the stock price of Amic on February 18 reached 133.102 billion yuan (ex-rights price), which is one of the few thousand yuan in the A-share market. Not long ago, the company also announced that it would spend 886 million to acquire a 25.4% stake in South Korean botulinum toxin company HuonsBio. At the same time, it also plans to go public in Hong Kong.

2. The IPO financing of sci-tech innovation board pharmaceutical companies blowout, and Baiyang Pharmaceutical surged 635% on the first day of listing

According to statistics from Flush Shun Iwencai, 27 pharmaceutical companies are listed on the A-share market in the first half of 2021, of which 5 are on the Growth Enterprise Market and 22 are on the Sci-tech Innovation Board (15 of which are medical device companies). At the same time, there were as many as 21 companies that doubled their growth on the first day of listing.

According to statistics, these 27 pharmaceutical companies’ "upstarts" raised a total of 20.409 billion yuan in initial funds, of which 19.071 billion yuan was raised on the science and technology innovation board, accounting for 93.44% of the total amount. Among them, Haoyuan Pharmaceutical, Beike Biology, Weigao Orthopedics, Zhonghong Medical, Zhijiang Biological, Xiangyu Medical, Aotai Biological and other first raised funds exceeded 1.1 billion yuan.

1. Laureate in the rising list of "upstarts" in medicine——Baiyang Pharmaceutical

On the first day of listing, Baiyang Pharmaceutical increased by 635.08% from the issue price of RMB 7.64 per share, with a total market value of 29.5 billion yuan, and won the “laurels” on the IPO growth list of pharmaceutical companies in the first half of the year. By providing comprehensive marketing services for pharmaceutical product manufacturers, it is the main business of Baiyang Pharmaceutical. Its product types include brand operation, wholesale distribution, retail and other businesses. Among them, in 2020, the pharmaceutical wholesale distribution business will achieve revenue of 3.371 billion yuan, accounting for 57.33%; brand product sales and promotion business revenue will be 2.166 billion yuan, accounting for 36.85%. Prior to this, Baiyang Pharmaceutical disclosed the performance forecast for the 2021 interim report: operating income is expected to be 3.573 billion to 3.766 billion, an increase of 47.16% to 55.10% over the same period of the previous year; net profit attributable to the parent is expected to be 174 million to 184 million. This represents an increase of 58.23% to 67.17% from the same period last year.

2. Bio-vaccine "new nobility"-Beike Biological, Olin Biological

Baike Biotechnology is another core subsidiary of Changchun Hi-tech Co., Ltd. besides Jinsai Pharmaceutical. In 2020, Changchun Hi-tech will achieve total revenue of 8.577 billion yuan, of which Jinsai Pharmaceutical’s revenue is 5.803 billion yuan, accounting for 67.66% of the company’s total revenue; Baike Bio’s revenue is 1.433 billion yuan, accounting for 16.71%. The two companies total The high proportion of 84.37% propped up the performance of Changchun Hi-tech. The main business of Baike Biology is the research and development, production and sales of human vaccines. Its products include human rabies vaccines, freeze-dried live attenuated nasal flu vaccines, and live attenuated varicella vaccines. Among them, in 2020, varicella vaccine will achieve revenue of 1.107 billion yuan, accounting for 76.83% of total revenue; nasal spray flu vaccine will achieve revenue of 333 million yuan, accounting for 23.08%. In terms of the R&D pipeline, the phase III clinical trial of the freeze-dried formulation of the rabies vaccine (Vero cells) for human use by Biologics has been basically completed; the clinical trial III of a live attenuated herpes zoster vaccine for the prevention of herpes zoster and complicated neuralgia in the elderly The phase trial has come to an end, with all 25,000 subjects enrolled in the group, leading the domestic progress.

Bai Ke biological research and development pipeline

Source: Beike Biotech Prospectus, China Securities Research Institute

In addition, Olin Bio's main products are adsorption tetanus vaccine, Hib conjugate vaccine, and tetanus toxoid concentrate stock solution. Among them, the amount of adsorbed tetanus vaccine issued in 2020 will be 3,137,900, and the income will be 62.136 million yuan, accounting for about 98% of the company's total revenue. However, Olin Biologics is highly dependent on a single species, making its performance growth volatile in recent years. From 2018 to 2020, the company's total revenue was 76.33 million yuan, 179 million yuan, and 320 million yuan, respectively, up 423%, 134.6%, and 78.7% year-on-year, and the growth rate showed a downward trend. During the same period, the deduction of non-net profits achieved -22.74 million yuan, -36.64 million yuan and 27.34 million yuan.

3. Conclusion

All in all, because the new crown epidemic has not yet been fully controlled, and under the influence of external factors, the current concepts of diagnostic reagents and vaccines are still more favored by investors than traditional medicine, and the relative investment value is also higher. However, grasping the core value of the company is still the unchanging development logic of the entire pharmaceutical industry. Excellent companies with beautiful performance, rich R&D pipelines and fast advancing, as well as medical stocks in the hottest track, will continue to be the main theme of the future pharmaceutical sector.