On August 9, the National Medical Insurance Administration issued the "Response of the National Medical Insurance Administration to Recommendation No. 4126 of the Fourth Session of the Thirteenth National People’s Congress", in response to the National People’s Congress representative Lu Qingguo’s "Regarding Accelerating the Entry of Chinese Medicines and Formula Granules into Centralized Procurement" Suggestion" question. The answer is clear: there have been policy arrangements and preliminary explorations for Chinese patent medicines to enter the centralized drug purchase; the relevant departments will adhere to the quality priority on the basis of improving the quality evaluation standards of Chinese patent medicines and formula granules, and be oriented by clinical demand, and value-added prices are high. Starting with large varieties, scientifically and steadily promote the reform of centralized procurement of Chinese patent medicines and formula granules. Proprietary Chinese medicine enters the centralized procurement, another official real hammer, slowly landing!

Figure 1 Screenshot of the official website

What varieties are most likely to be collected?

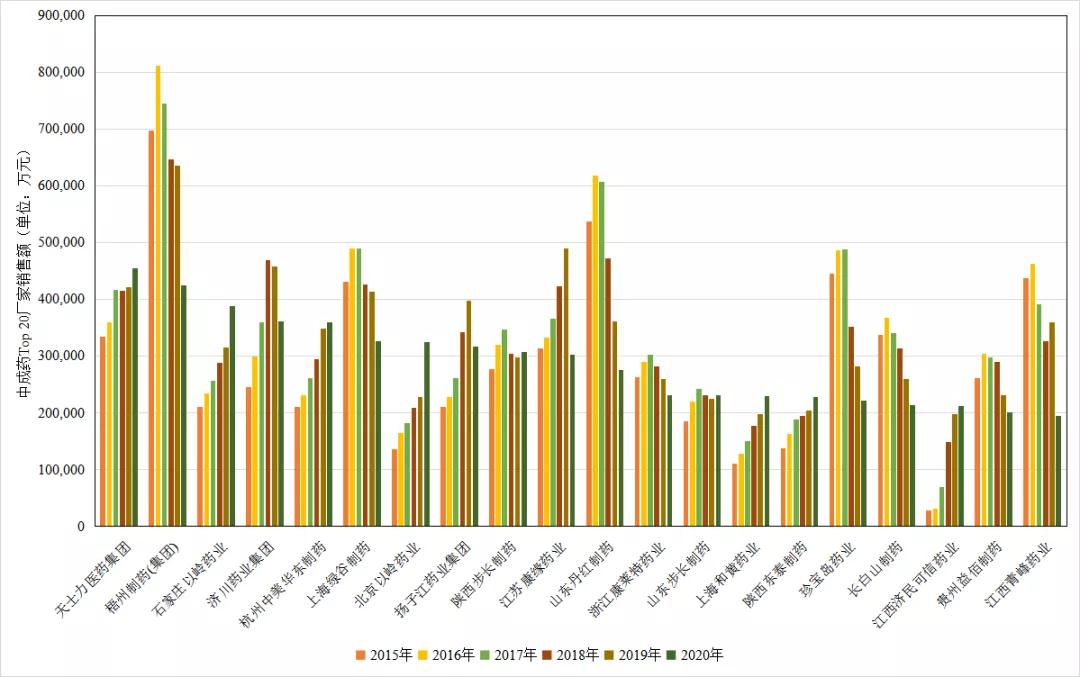

Starting with high-priced and large-volume varieties provides key clues for the centralized procurement of Chinese patent medicines and formula particles. From the competitive landscape of Chinese patent medicine terminal varieties in public hospitals in Chinese cities, we can see that the annual sales of the top 20 varieties basically exceed the 1 billion mark, which is a veritable blockbuster. The top 10 sales varieties include: Ginkgo biloba preparations, Xuesaitong, Xueshuantong, Bailing, compound salvia miltiorrhiza, salvia miltiorrhiza polyphenolate, Yunnan Baiyao, Danhong, Naoxintong, and Tongxinluo. Among them, the sales of Ginkgo biloba preparations, Xuesaitong and Xueshuantong are in the first echelon, with sales steadily surpassing 5 billion yuan, which is significantly higher than other products. Especially ginkgo biloba preparations, in 2018, also exceeded the 10 billion mark. From the top 20 competition, we can see that the main products are cardiovascular and cerebrovascular products. The top three are all aimed at the cardiovascular and cerebrovascular products. In the Top 10, except for Bailing and Yunnan Baiyao, which are the fish that slip through the net, the others are all cardiovascular and cerebrovascular treatments. drug. These large-species treatment areas are clinically major diseases, which are in line with "Clinical demand-oriented, starting from high-priced and large-volume varieties." Under the background of medical insurance control fees, how much can these blockbusters worth more than one billion yuan? Escaped this disaster?

Figure 2 China's urban public, urban community, county-level public, township public health, the top 20 generic names of proprietary Chinese medicines (unit: ten thousand yuan)

Which companies may be the most impacted?

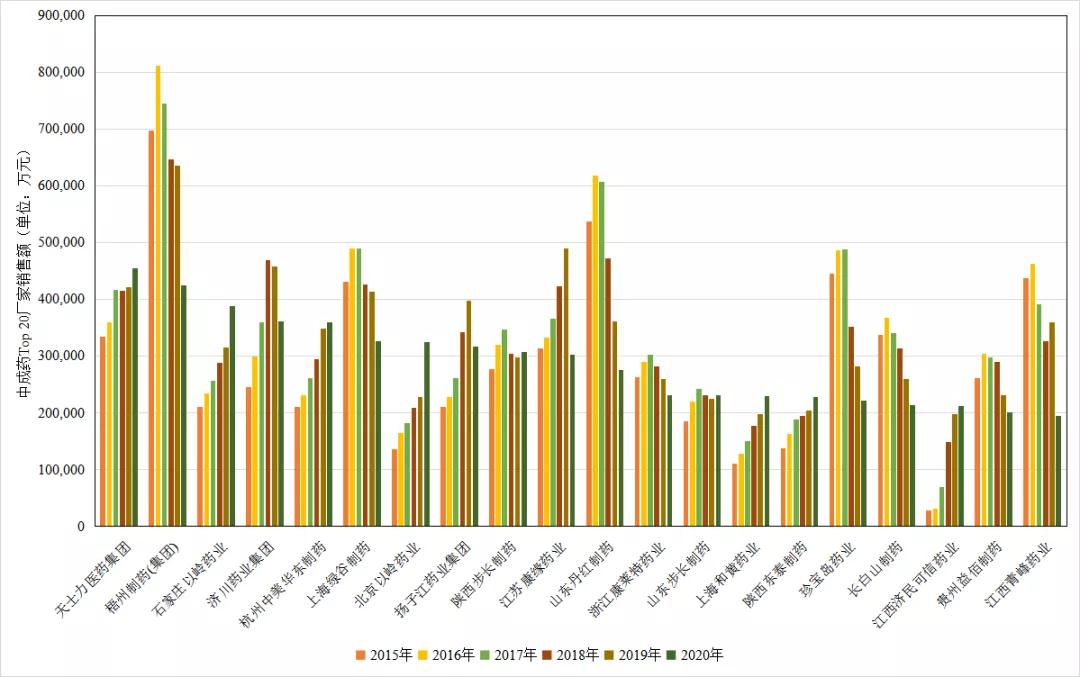

Companies with high sales amounts, large sales, and many different generic drugs with similar indications or functions and indications bear the brunt and are most likely to tremble. From the competitive landscape of Chinese patent medicine terminal manufacturers in public hospitals in China, we can see that the top 10 companies with leading sales of Chinese patent medicines are: Tasly Pharmaceutical Group, Wuzhou Pharmaceutical (Group), Shijiazhuang Yiling Pharmaceutical, and Jichuan Pharmaceutical Group, Hangzhou Zhongmei Huadong Pharmaceutical, Shanghai Green Valley Pharmaceutical, Beijing Yiling Pharmaceutical, Yangzijiang Pharmaceutical Group, Shaanxi Buchang Pharmaceutical, Jiangsu Kangyuan Pharmaceutical. The top 10 pharmaceutical companies' sales of proprietary Chinese medicines in urban public hospitals are all over 3 billion yuan. Among them, Wuzhou Pharmaceutical (Group) has led the way in the past few years. After the blockbuster product "Xueshuantong" was hit in 2020, its performance dropped significantly, and Tasly reached the top. Subsequent companies compete fiercely, with little difference in strength. Further comparison found that Top20 companies are basically linked to Top20 varieties. For example, Tasly Pharmaceutical Group has compound Danshen dripping pills (ranked 5th in the variety), Wuzhou Pharmaceutical has Xueshuantong for injection (ranked 3rd in the variety), and Hangzhou Zhongmei Huadong Pharmaceutical has Bailing capsules (ranked 4th in the variety). Shanghai Lvgu Pharmaceutical has Salvia miltiorrhiza polyphenolate for injection (ranking 6th among varieties), and Shandong Danhong Pharmaceutical has Danhong injection (ranking 8th among varieties)... These blockbuster products support the company to enter the annual sales list. The important support of the company, just imagine, if these large single products are included in the centralized procurement, how much will the impact on these companies be?

Figure 3 Annual sales pattern of TOP20 proprietary Chinese medicine manufacturers in China's urban public, urban community, county-level public, and township public health facilities (unit: ten thousand yuan)

Why are formula particles appearing here?

In February 2021, the State Food and Drug Administration and other four departments jointly issued the "Announcement on Ending the Pilot Work of TCM Formula Granules", which ended the 20-year pilot work of TCM formula granules, and the "conversion of identity" laid the foundation for the development of formula granules. Base. The formula particles are highly standardized and portable, in line with the principle of "quality first", and success becomes the protagonist when it comes time. Research data shows that from 2015 to 2019, the market size of the formula granule industry (based on terminal sales) increased from 14.36 billion yuan to 25.56 billion yuan, with a compound annual growth rate of 15.5%. It is conservatively estimated that the industry size will be 2025 Will reach 54.3 billion. At present, more than 60 companies across the country have deployed, and pilot companies still have about 200-300 standard research materials for formula granules that are ready to be submitted. The overall quality control and effective supervision of formula particles have accelerated industry standardization and standardization. We will wait and see whether the newly-regulated formula particles will become the "popular names" in the collection of traditional Chinese medicine.

Opportunities and challenges in the industry

The two sessions are the vane of national policies, and the response given by the National Medical Security Administration to Recommendation No. 4126 of the Fourth Session of the Thirteenth National People's Congress is an outpost signal. Through the implementation of centralized procurement bidding, promoting large-scale production and operation of traditional Chinese medicine enterprises, reducing the cost of traditional Chinese medicine, improving the evaluation system of technological innovation in traditional Chinese medicine, and promoting the healthy development of the traditional Chinese medicine industry is a common topic in the country. Combining sporadic policies with published official documents, the trend of reshuffle in the Chinese medicine industry has become clear. Regardless of whether proprietary Chinese medicines participate in mass procurement in the short term, companies should make great efforts to improve product strength and productivity, strengthen source control and quality assurance, so as to realize the supply-side structural reform in the true sense. In the future, it is speculated that the centralized procurement of Chinese patent medicines may be implemented: the first is the vertical mode of advancing the pace. The varieties of proprietary Chinese medicines with “clear active ingredients, clear indications, large amounts of use, a high proportion of money, and a good competitive landscape” are given priority to become the first batch of proprietary Chinese medicines to be purchased in quantities, followed by the establishment of quality standards and evaluation systems Expand the encirclement step by step. The second type is "price limit without quantity". Because proprietary Chinese medicines are generally used beyond indications, if the amount of use is not controlled, a drop in the price will cause a substantial increase in the amount of use, which will increase the burden on the medical insurance fund. Therefore, separate the racetrack for major diseases and exact clinical symptoms, without distinguishing whether there are generic drugs, and implement centralized procurement for products with exact clinical goals (which can be used as substitutes for each other) regardless of the name of the product, so as to squeeze out The price of medicine may also be a potential idea. Chinese patent medicines are coming into centralized procurement, quality requirements are soaring, and hospitals restrict their use. It seems that the winter of Chinese patent medicines is about to come. But when winter comes, can spring be far behind?